Chapter 8 Sources of Business Finance Questions and Answers: NCERT Solutions for Class 11th Business Studies

Class 11 Business Studies Chapter 8: Sources of Business Finance - Questions and Answers of NCERT Book Solutions.

Question 1. What is business finance? Why do businesses need funds? Explain.

Answer: Business is concerned with production and distribution of goods and services for the satisfaction of need of society. A business cannot function unless adequate funds are made available to it. The need of fund arises from the stage when an entrepreneur makes a decision to start a business. Some funds are needed immediately. The financial need of a business can be categorized in the following ways:

* Fixed Capital Requirements: In order to start business, funds are required to purchase fixed assets like land and building, plant and machinery, and furniture and fixures. This is known as fixed capital requirement of an enterprise.

* Working Capital Requirements: The financial requirements of an enterprise do not end with the procurement of fixed assets. No matter how small or large business, it need funds for its day-to-day operations. This is known as working capital of an enterprise which is used for holding current assets like stock, bill receivable, current expenses etc. Therefore, a business needs funds to meet its fixed as well as working capital requirements.

Question 2. List sources of raising long-term and short term finance.

Answer: Sources of raising long term and short term finance are shown in the chart given below:

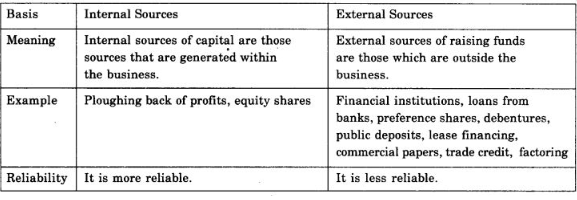

Question 3. What is the difference between internal and external sources of raising funds? Explain.

Answer: The differences between interned and external sources of raising funds are summarized in the table given as follows:

Question 4. What preferential rights are enjoyed by preference shareholders? Explain.

Answer: Following preferential rights are enjoyed by the preference shareholders:

* They get dividend at a fixed rate and dividend is given on these shares before any dividend on equity shares.

* When company winds up, preference shares are paid before equity shares.

* Preference shares also have a right to participate in excess profits left after payment being made to equity shares.

* They also have a right to participate in the premium at the time of redemption. In lieu of these preferential rights, their voting rights are taken i.e. they are not eligible for voting.

Question 5. Name any three special financial institutions and state their objectives.

Answer: Given below are three financial institutions along with their objectives:

1. Industrial Credit and Investment Corporation of India (ICICI): It came into existence in 1955 as a public limited company under the Companies Act, 1956. Objective: ICICI assists the expansion and modernisation of industrial enterprises exclusively in the private sector. The corporation has also encouraged the participation of foreign capital in the country.

2. Industrial Development Bank of India (IDBI): It came into existence in 1964 under the Industrial Development Bank of India Act, 1964.

Objective: Its objective was to coordinate the activities of other financial institutions including commercial banks. The bank performed three types of functions namely, assistance to other financial institutions, direct assistance to industrial concerns and promotion and coordination of financial technique service.

3. Life Insurance Corporation of India (LIC): It came into existence in 1956 under the LIC Act 1956 after nationalising 245 existing insurance companies.

Objective: It mobilises the community saving in the form of insurance premia and makes it available to industrial concerns. Both public as well as private, in the form of direct loan and underwriting of an subscription to shares and debentures.

Question 6. What is the difference between GDR and ADR? Explain.

Answer: Global Depository Receipts (GDRs): GDR is an instrument issued by a company to raise funds in some foreign currency and is listed and traded on a foreign stock exchange. American Depository Receipts (ADRs): The depository receipts issued by the company in the USA are called American Depository Receipts.

GDR and ADR are similar to each other except:

* GDR can be issued to anyone but ADRs can be issued only to an American citizen.

* GDR can be listed and traded in stock exchange of any country but ADRs can be listed and traded only in the stock exchange of USA.

Long Answer Type Questions

Question 1. Explain trade credit and bank credit as sources of short term finance for business enterprises.

Answer: Trade Credit: Trade credit is the credit extended by the trader to another to purchase goods and services. It facilitates the purchase of supplies without immediate payment. In books of accounts they are shown as “creditors’ or ‘ills payable’.

Merits of Trade Credit

* It is a convenient and continuous source of finance.

* It is readily available.

* It helps in promoting sales of an organization.

* If an organization wants to expand its inventory level so as to meet expected rise in demand, it may use trade credit.

* It does not demand any security.

Demerits of Trade Credit

* When easy and flexible trade credit is available, it may induce the firm to indulge in over trading.

* Trade credit can meet only limited financial needs. Funds required for inventory can be met through it but not others like plant and machinery, land and building or salaries of employees etc.

Bank Credit: Borrowings from banks are an important source of finance to companies. Bank lending is still mainly short term, although medium-term lending is quite common these days.

Short term lending may be in the form of:

* An overdraft, which a company should keep within a limit set by the bank. Interest is charged (at a variable rate) on the amount by which the company is overdrawn from day to day.

* A short-term loan, for up to three years.

* Medium-term loans are loans for a period of three to ten years.

The rate of interest charged on medium-term bank lending to large companies will be a set margin, with the size of the margin depending on the credit standing and risk of the borrower. A loan may have a fixed rate of interest or a variable interest rate, so that the rate of interest charged will be adjusted every three, six, nine or twelve months in line with recent movements in the Base Lending Rate.

Merits of Bank Credit

* Economical: Rate of interest charged by banks is quite nominal and is therefore economical.

* Maintains business secrecy: Banks maintain secrecy of the business. They do not disclose the information shared to any third party.

* Less formalities: As compared to issue of shares, debentures or accepting public deposits, it has less legal formalities..

* Flexible source: It can be increased or decreased as per the requirements of the business. It is not so that once a loan is taken it can’t be reduced.

Limitations of Bank Credit

* Short-term financing: It does not provide loans for long term as shares and debentures do.

* Difficult procedure: As compared to commercial papers and trade credit, it involves many legal and paper formalities. It makes its procedure difficult.

* Restrictive clauses: Bank credit has many restrictive clauses which includes mortgage on company’s assets or ineligibility to raise funds from specific sources.

Question 2. Discuss the sources from which a large industrial enterprise can raise capital for financing modernisation and expansion.

Answer: A large industrial enterprise can raise capital from the following sources.

1. Equity Shares: Equity shares are the most important source of raising long term capital by a company. They represent the ownership of a company and therefore, the capital raised by issue of these shares is called owner’s funds. These shareholders do not get a fixed dividend. They get according to the earnings of the company. They receive what is left after all other claims on the company’s income and assets have been settled. They enjoy the reward and also bear the risk of ownership. They have voting rights. Using their voting rights, they get participation in management of the company.

2. Preference Shares: Preference shareholders are called so because they enjoy some preferential rights over equity shares. They get dividend at a fixed rate and dividend is given on these shares before any dividend on equity shares. When company winds up, preference shares are paid before equity shares. Preference shares also have a right to participate in excess profits left after payment being made to equity shares. They also have a right to participate in the premium at the time of redemption. In lieu of these preferential rights, their voting rights are taken i.e. they are not eligible for voting. Preference shares have some characteristics of equity shares as well as debentures. They are safer investment with stable return from investor’s point of view and free from control from owner’s point of view.

3. Debentures: Debenture is an acknowledgement by a company that the company has borrowed certain amount from the debenture holder which it promises to pay on a specific date. It is an important source for raising long term debt capital. Debentures bear a fixed rate of interest. In recent times, issue of zero interest debentures has also become popular which do not carry any explicit rate of interest. But they are issued at discount and redeemed at a premium or at par. It is the return on the debenture. Public issue of debentures requires that issue of debentures should be rated by a credit rating agency like CRISIL (Creditrating and Information Services of India Limited).

4. Loans from Financial Institutions: The government has established many financial institutions like LIC, IDBI, ICICI etc all over the country to provide finance to these organizations. These institutions are established by central and state government both. These institutions provide owned capital as well as borrowed capital for long term and short term requirements. They provide financial and technical advice and consultancy to business firms. Obtaining loan from a financial institution increases goodwill of a company. These sources are available even during depression. Loans can be repaid in easy instalments.

5. Loans from Commercial Banks: Borrowings from banks are an important source of finance to companies. Bank lending is still mainly short term, although medium- term lending is quite common these days. The rate of interest charged on medium- term bank lending to large companies will be a set margin, with the size of the margin depending on the credit standing and risk of the borrower. A loan may have a fixed rate of interest or a variable interest rate, so that the rate of interest charged will be adjusted every three, six, nine or twelve months in line with recent movements in the Base Lending Rate. Short term lending may be in the form of:

(i) An overdraft, which a company should keep within a limit set by the bank. Interest is charged (at a variable rate) on the amount by which the company is overdrawn from day to day.

(ii) A short-term loan, for up to three years.

(iii) Medium-term loans are loans for a period of three to ten years.

6. Retained Earnings: For any company, the amount of earnings retained within the business has a direct impact on the amount of dividends. Profit re-invested as retained earnings is profit that could have been paid as a dividend. The management of many companies believes that retained earnings are funds which do not cost anything, although this is not true. However, it is true that the use of retained earnings as a source of funds does not lead to a payment of cash. In practice, the dividend policy of the company is determined by the directors. From their standpoint, retained earnings are an attractive source of finance because investment projects can be undertaken without involving either the shareholders or any outsiders. The use of retained earnings as opposed to new shares or debentures avoids issue costs. The use of retained earnings avoids the possibility of a change in control resulting from an issue of new shares. Another factor that may be of importance is the financial and taxation position of the company’s shareholders. For example, because of taxation considerations, they would rather make a capital profit (which will only be taxed when shares are sold) than receive current income, then finance through retained earnings would be preferred to other methods.

Question 3. What advantage does issue of debentures provide over the issue of equity shares?

Answer: Debentures provide following advantages over issue of equity shares.

1. Voting Rights: Voting rights are not given to debentures while equity shareholders have voting rights.

2. Dilution of Controlling Power: Since voting power is not given, therefore, if funds are raised by issue of debentures then controlling power does not get diluted.

3. Redeemable: Debentures are redeemable. Therefore, funds become flexible. When funds are not required permanently but for 5 or 10 years, debentures are more suitable.

4. Fixed Rate of Interest: Debentures are to be paid at fixed rate of interest. However, we need to share profits with equity shareholders.

5. Creditor versus Owner: Debenture holder is a creditor of the company and cannot take part in the management of the company while a shareholder is the owner of the company. It is the basic distinction between a debenture and a share.

6. Convertibility: Shares cannot be converted into debentures whereas debentures can be converted into shares.

Question 4. State the merits and demerits of public deposits and retained earnings as methods of business finance.

Answer: Public Deposits: Deposits accepted from public directly by the companies are called public deposits. These deposits generally carry a rate of interest higher than the deposits in commercial banks.

Merits of Public Deposits

* The procedure of obtaining deposits is simple and does not contain restrictive conditions.

* Cost of public deposits is generally lower than the cost of borrowings from banks and financial institutions.

* Public company usually does not create a charge on the assets of the company.

* As the depositors do not have voting rights, it does not dilute control in the company.

Demerits of Public Deposits

* It is difficult for a newly established company to be able to get funds from public deposits.

* It is dependent on public response and can’t be relied on if financial needs are urgent.

* It is difficult especially when size of deposits is large.

Retained Earnings: For any company, the amount of earnings retained within the business has a direct impact on the amount of dividends. Profit re-invested as retained earnings is profit that could have been paid as a dividend.

Merits of Retained Earnings:

* The management of many companies believes that retained earnings are funds which do not cost anything, although this is not true. However, it is true that the use of retained earnings as a source of funds does not lead to the payment of cash.

* The dividend policy of the company is in practice determined by the directors. From their standpoint, retained earnings are an attractive source of finance because investment projects can be undertaken without involving either the shareholders or any outsiders.

* The use of retained earnings as opposed to new shares or debentures avoids issue costs.

* The use of retained earnings avoids the possibility of a change in control resulting from an issue of new shares.

* Another factor that may be of importance is the financial and taxation position of the company’s shareholders. For example, because of taxation considerations, they would rather make a capital profit (which will only be taxed when shares are sold) than receive current income, then finance through retained earnings would be preferred to other methods.

Demerits of Retained Earnings:

* A company must restrict its self-financing through retained profits because shareholders should be paid a reasonable dividend, in line with realistic expectations, even if the directors would rather keep the funds for re-investing.

* At the same time, a company that is looking for extra funds will not be expected by investors (such as banks) to pay generous dividends, nor over-generous salaries to owner-directors.

* Scope of retained earnings is limited by amount of profits. A loss incurring firm has no source called retained earnings.

Question 5. Discuss the financial instruments used in international financing.

Answer: Following financial instruments are used in international financing:

1. Global Depository Receipts (GDRs): The local currency shares of a company are delivered to the depository bank. The depository bank issues depository receipts against these shares. When these depository receipts are denominated in US $, they are called GDR. It is a bank certificate issued in more than one country for shares in a foreign company. The shares are held by a foreign branch of an international bank. The shares trade as domestic shares, but are offered for sale globally through the various bank branches. A financial instrument used by private markets to raise capital denominated in either U.S. dollars or Euros. These instruments are called EDRs when private markets are attempting to obtain Euros. It is a negotiable instrument and can be traded freely like any other security. A holder of GDR can convert it into any other security at any time. Holders of GDR are eligible only for capital appreciation and dividend but no voting rights.

2. American Depository Receipts (ADRs): When a company in the USA issues depository receipts, they are termed as American Depository Receipts (ADRs). These are bought and sold in stock markets of the USA. They are similar to GDR except that these can be issued only to American citizens and these can be listed and traded on a stock exchange of USA.

3. Foreign Currency Convertible Bonds (FCCBs): Foreign Currency Convertible Bonds are equity linked debt securities that are to be converted into equity or depository receipts after a specific period. Foreign Currency Convertible Bonds are listed and traded in Foreign Stock Exchanges. A holder of Foreign Currency Convertible Bonds has the option of converting them into equity shares at a pre-determined price. Foreign Currency Convertible Bonds are issued in foreign currency. Their rate of interest is lower than rate of any other similar non convertible debt instrument.

Question 6. What is commercial paper? What are its advantages and limitations?

Answer: Commercial Paper:

* Commercial paper is an unsecured, short-term debt instrument issued by a corporation, typically for the financing of accounts receivable, inventories and meeting short-term liabilities.

* Maturities on commercial paper can range up to 365 days. The debt is usually issued at a discount, reflecting prevailing market interest rates.

* Commercial paper is not usually backed by any form of collateral, so only firms with high-quality debt ratings will easily find buyers without having to offer a substantial discount (higher cost) for the debt issue.

Advantages and Limitations of Commercial Paper Advantages:

* For the most part, commercial paper is a very safe investment because the financial situation of a company can easily be predicted over a few months.

* Typically only companies with high credit ratings and creditworthiness issue commercial paper. Hence the companies issuing them enjoy (a) the prestige associated

with such issuance and (b) the ability to issue large quantum without much hassles like other types of financing which requires restrictions from regulatory bodies.

* Interest rate is generally lower compared to others like bank loans and other types of short term financing

Disadvantage:

* It does not have any flexibility with regard to repayments

Last Updated on: Mar 28, 2024