Chapter 3 Reconstitution of a Partnership Firm – Retirement/Death of a Partner Questions and Answers: NCERT Solutions for Class 12 Accountancy (Partnership Accounts)

x

CBSE 10th Date sheet 2024 CBSE 12th Date Sheet 2024

Question 2. The old profit sharing ratio among Rajender, Satish and Tejpal were 2:2:1. The new profit sharing ratio after Satish’s

Answer (c)

Answer. (a)

Question 4. In the absence of any information regarding the acquisition of share in profit of the retiring/deceased partner by the remaining partners, it is assumed that they acquire his/her share

(a) old profit sharing ratio

Question 1. On retirement/death of a partner, the retiring/deceased partner’s capital account will be credited with

Question 2. Gobind, Hari and Pratap are partners. On retirement of Gobind, the goodwill already appears in the Balance Sheet at T

Question 3.Chaman, Raman and Suman are partners sharing profits in the ratio of 5:3:2. Raman retires, the new profit sharing ratio

Answer (c)

Question 4. On retirement/death of a partner, the remaining partner(s) who have gained

Answer A partner can retire from the firm in three different ways. They are as follow

Answer The following are the various matters that need to be adjusted at the time of retirement of partners/partner

Answer Difference between Sacrificing and Gaining Ratio

Answer Payment to a retiring partner can be made in the following ways

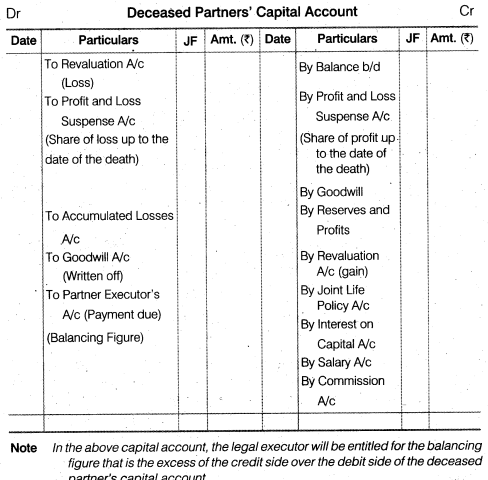

Answer In case of a death, the legal executor of the deceased partner is entitled for a claim which includes his share of profit or loss, interest on capital, interest on drawings In that case for computing the amount payable is calculated by preparing the deceased partner’s capital account as follows

Answer At the time of retirement or is the event of death of a partner, the goodwill of the firm is adjusted among the partners in their gaining ratio with the share of goodwill of the retiring or the deceased partner. At the time of retirement or on the event of death of a partner, goodwill account is not opened hence only two situations are left for treating the goodwill first when

goodwill account is already there in the book or it appear in the books and second when the amount of goodwill is not appearing in the books.

The treatment of goodwill will be as follows in the above two situations

First Situation When Goodwill Already Appears in the Books of the Firm

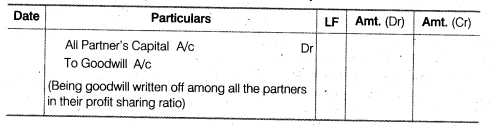

Step 1 Write-off the Existing Goodwill When goodwill account already exist in the book of the firm or mentioned in the book first of all, it will be written oft and should be distributed among all the partners of the firm including the retiring or the deceased partner in their old profit sharing ratio. In that case, the journal entry will be as follows

Answer Computation of profit will be different in case of death of a partner as compare to the retirement. The reason is that in case of retirement everything is pre-planned but in case of death nothing is planned. In case of death, the share of profit.can be calculated by one of the two methods.

Last Updated on: December 05, 2025

Class 12 Accountancy chapter 3 - Reconstitution of a Partnership Firm – Retirement/Death of a Partner - Questions and Answers of NCERT Book Solutions.

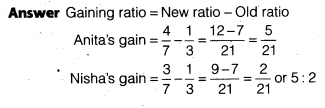

Question 1. Anita, Jaya and Nisha are partners sharing profits and losses in the ratio of 1:1:1 Jaya retires from the firm. Anita and Nisha decided to share the profit in future in the ratio 4 :3. Calculate the gaining ratio.

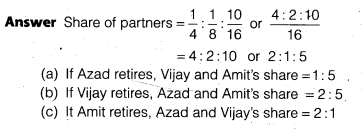

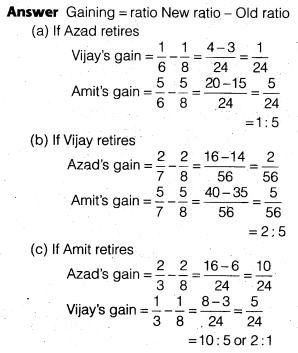

Question 2. Azad, Vijay and Amit are partners sharing profits and losses in the proportion of 1/4,1/8,10/16 and Calculate the new profit sharing ratio between continuing partners if (a) Azad retires; (b) Vijay retires; (c) Amit retires.

Question 3. Calculate the gaining ratio in each of the above situations.

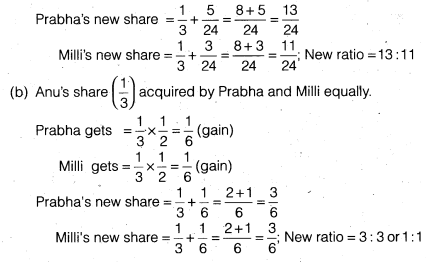

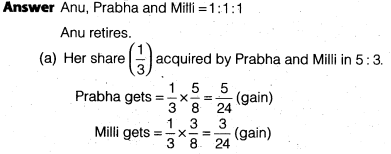

Question 4.Anu, Prabha and Milli are partners. Anu retires. Calculate the future profit sharing ratio of continuing partners and gaining ratio if they agree to acquire her share : (a) in the ratio of 5:3; (b) equally.

Question 5. Rahul, Robin and Rajesh are partners sharing profits in the ratio of 3 : 2 : 1. Calculate the new profit sharing ratio of the remaining partners if (i) Rahul retires; (ii) Robin retires; (iii) Rajesh retires.

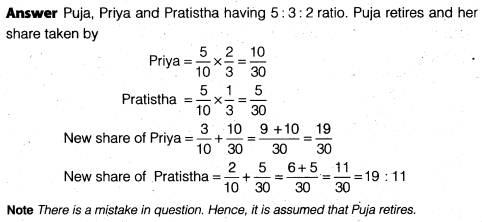

Question 6.Puja, Priya, Pratistha are partners sharing profits and losses in the ratio of 5 : 3 : 2. Priya retires. Her share is taken by Priya and Pratistha in the ratio of 2 : 1. Calculate the new profit sharing ratio.

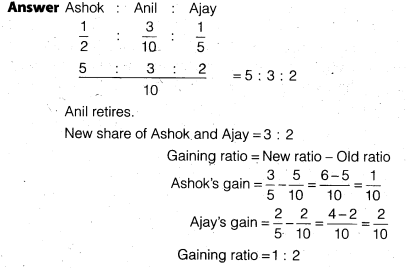

Question 7.Ashok, Anil and Ajay are partners sharing profits and losses in the ratio of 1/2, 3/10 and 1/5. . Anil retires from the firm. Ashok and Ajay decide to share future profits and losses in the ratio of 3 : 2. Calculate the gaining ratio.

TEST YOUR UNDERSTANDING I

Question1. Abhishek, Rajat and Vivek are partners sharing profits in the ratio of 5:3:2. If Vivek retires, the New Profit Sharing Ratio between Abhishek and Rajat will be– (a) 3:2 (b) 5:3 (c) 5:2 (d) None of these

Answer.(b) 5 :3

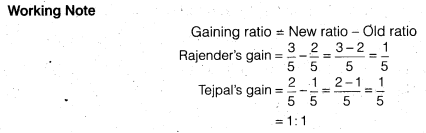

Question 2. The old profit sharing ratio among Rajender, Satish and Tejpal were 2:2:1. The new profit sharing ratio after Satish’s

retirement is 3:2. The gaining ratio is

(a) 3 : 2 (b) 2 : 1

(c) 1 : 1 (d) 2 : 2

Answer (c)

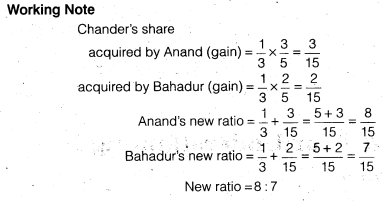

Question 3. Anand, Bahadur and Chander are partners. Sharing Profit equally on Chander’s retirement, his share is acquired by Anand and Bahadur in the ratio of 3 : 2. The new profit sharing ratio between Anand and Bahadur will be (a) 8 : 7 (b) 4 : 5 (c) 3 : 2 (d) 2:3

Answer. (a)

Question 4. In the absence of any information regarding the acquisition of share in profit of the retiring/deceased partner by the remaining partners, it is assumed that they acquire his/her share

(a) old profit sharing ratio

(b) new profit sharing ratio

(c) equal ratio

(d) None of these

Answer (a) Old profit sharing ratio

TEST YOUR UNDERSTANDING II

Question 1. On retirement/death of a partner, the retiring/deceased partner’s capital account will be credited with

(a) his/her share of goodwill

(b) goodwill of the firm

(c) shares of goodwill of remaining partners

(d) None of the above

Answer (a) His/Her share of Goodwill

Question 2. Gobind, Hari and Pratap are partners. On retirement of Gobind, the goodwill already appears in the Balance Sheet at T

24,000. The goodwill will be written off

(a) by debiting all partners’ capital accounts in their old profit sharing ratio

(b) by debiting remaining partners’ capital accounts in their new profit sharing ratio

(c) by debiting retiring partners’ capital accounts from his share of goodwill

(d) None of the above

Answer (a) By debiting all partners’ capital accounts in their old profit sharing ratio

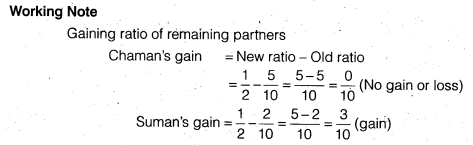

Question 3.Chaman, Raman and Suman are partners sharing profits in the ratio of 5:3:2. Raman retires, the new profit sharing ratio

between Chaman and Suman will be 1:1. The goodwill of the firm is valued at Rs. 1,00,000 Raman’s share of goodwill will be adjusted

(a) by debiting Chaman’s Capital account and Suman’s Capital Account with Rs 15,000 each.

(b) by debiting Chaman’s Capital account and Suman’s Capital Account with Rs. 21,429 and 8,571 respectively.

(c) by debiting only Suman’s Capital Account with Rs. 30,000.

(d) by debiting Raman’s Capital account with Rs. 30,000.

Answer (c)

Question 4. On retirement/death of a partner, the remaining partner(s) who have gained

due to change in profit sharing ratio should compensate the

(a) retiring partners only.

(b) remaining partners (who have sacrificed) as well as retiring partners.

(c) remaining partners only (who have sacrificed).

(d) none of these.

Answer (b) Remaining partners (who have sacrificed) as well as partners

Short Answer Type Questions

Question 1. What are the different ways in which a partner can retire from the firm?

Answer A partner can retire from the firm in three different ways. They are as follow

(i) Retirement Through Mutual Consent A partnership firm take its shape through mutual consent of partners in the same way. A partner may

retire if all the partners agree on the decision of his/her retirement.

(ii) When There is a Provision in Partnership Deed When there is a provision for the retirement of a partner in the partnership deed in

that case partner may retire from the firm by expressing his/her intention of leaving the firm though a notice to the other partners of the firm.

(iii) Retirement Through Written Notice In case when partnership among the partners is at will, then a partner may retire by giving notice in writing to all the other partners informing them about his/her intention to retire.

Question 2. Write the various matters that need adjustments at the time of retirement of partners.

Answer The following are the various matters that need to be adjusted at the time of retirement of partners/partner

(i) Revaluation of assets and liabilities of the new firm.

(ii) Calculation of goodwill of the new firm and its accounting treatment.

(iii) Calculation of new ratio of the remaining partners of the firm.

(iv) Computation of new gaining ratio among rest of the partners.

(v) Distribution of accumulated profits and losses and reserves among all the partners (including the retiring partner).

(vi) Treatment of Joint Life Policy.

(vii) Disposal of the amount due to the retiring partner

(viii) Adjustment of capital accounts of the remaining partners in their new profit sharing ratio.

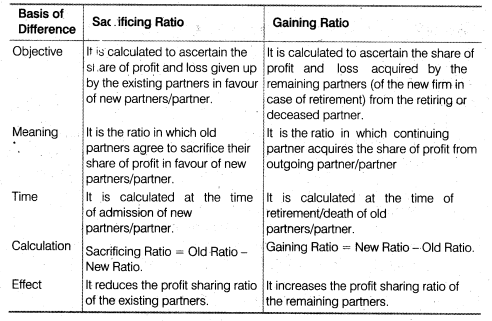

Question 3. Distinguish between sacrificing ratio and gaining ratio.

Answer Difference between Sacrificing and Gaining Ratio

Question 4. Why do firm revaluate assets and reassess their liabilities on retirement or on the event of death of a partner?

Answer At the time of retirement or death of a partner, it becomes inevitable to revalue the assets and liabilities of the firm for ascertaining their true and fair values. The revaluation is necessary as the value of assets and liabilities may increase or decrease with the passage of time. Further, it may be possible that there are certain assets and liabilities that remained unrecorded in the books of accounts. The retiring or the deceased partner may be benefitted or may bear loss due to change in the values of assets and liabilities. Therefore, the revaluation of the assets and liabilities is necessary in order to ascertain the true profit or loss that is to be divided among all the partners in their old profit sharing ratio.

Question 5. Why a retiring/deceased partner is entitled to a share of goodwill of the firm?

Answer. Goodwill is an intangible asset of a firm that is earned by the efforts of all the partners of the firm. After the retirement or death of a partner, the fruits of the past performance and reputation will be shared only by the remaining partners. Thus, the remaining partners should compensate the retiring orthe deceased partner by entitling him/her a share of firm’s goodwill.

Long Answer Type Questions

Question 1. Explain the modes of payment to a retiring partner.

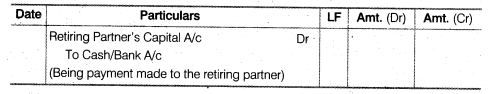

Answer Payment to a retiring partner can be made in the following ways

(i) Lump Sum Payment : A lump sum payment can be made to the retiring partner in full settlement. In that case, the following Journal entry

will be passed

(ii) Opening the Loan Account Sometimes the amount due to the retiring partner is paid in instalments then the balancing figure of his/her capital account is transferred to his/her loan account, in this case, the retiring partner receives equal instalments along with the interest on the amount outstanding. In that case the following journal entries will be passed for transferring the amount paid to him/her in retiring partner’s loan account.

-answer.png)

(iii)Some Payment in Cash and Some in Instalment Sometimes the amount due to the retiring partner is paid partly in cash and partly in equal instalments in that case a certain amount is paid in cash to the retiring partner and the rest amount due to him/her is transferred to his/her loan account. The following necessary journal entry is to be passed.

-answer.png)

Question 2. How will you compute the amount payable to a deceased partner?

Answer In case of a death, the legal executor of the deceased partner is entitled for a claim which includes his share of profit or loss, interest on capital, interest on drawings In that case for computing the amount payable is calculated by preparing the deceased partner’s capital account as follows

Question 3. Explain the treatment of goodwill at the time of retirement or on the event of death of a partner.

Answer At the time of retirement or is the event of death of a partner, the goodwill of the firm is adjusted among the partners in their gaining ratio with the share of goodwill of the retiring or the deceased partner. At the time of retirement or on the event of death of a partner, goodwill account is not opened hence only two situations are left for treating the goodwill first when

goodwill account is already there in the book or it appear in the books and second when the amount of goodwill is not appearing in the books.

The treatment of goodwill will be as follows in the above two situations

First Situation When Goodwill Already Appears in the Books of the Firm

Step 1 Write-off the Existing Goodwill When goodwill account already exist in the book of the firm or mentioned in the book first of all, it will be written oft and should be distributed among all the partners of the firm including the retiring or the deceased partner in their old profit sharing ratio. In that case, the journal entry will be as follows

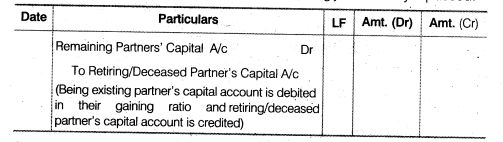

Step 2 Adjusting Goodwill Through Partners’ Capital Account

After writing off the old goodwill, the amount of goodwill now needs to be adjusted through the partner’s capital account with the share of the goodwill of the retiring orthe deceased partner. The following journal entry is passed.

Second Situation When No Goodwill Appears in the Books of the Firm

In second case, when no goodwill appears in the books of the firm, the amount of goodwill will be adjusted through the partner’s capital account with the share of the goodwill of the retiring or the deceased partner. The following journal entry’is passed

-answer.png)

Question 4. Discuss the various methods of computing the share in profits in the event of death of a partner.

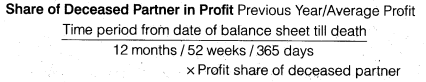

Answer Computation of profit will be different in case of death of a partner as compare to the retirement. The reason is that in case of retirement everything is pre-planned but in case of death nothing is planned. In case of death, the share of profit.can be calculated by one of the two methods.

(i) On the Basis of Time

In this method, profit upto the date of the death of the partner is calculated on the basis of time passed till the death of the partner from the beginning of the year on the bases of the last year’s/years’ profit or average profit of last few years.

The assumption in this method is that the profit will be uniform throughout the current year. The share of the deceased partner profit will be calculated as follows

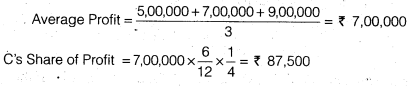

Example A, B, C and D are equal partners. The profit of the firm for the years 2009, 2010 and 2011 are ? 5,00,000, ? 7,00.000 and <9,00,000 respectively. C dies on June 30, 2012. The share of C in the firm’s profit will be calculated on the basis of average profit of last three years. Firm closes its books every year on December 31.

In this case, C’s share in the profits will be calculated for four months. i e., from January 1. 2012

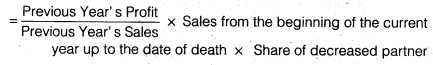

(ii) On the Basis of Sale

In this method, profit up to the date of the death of the partner is calculated on the basis of sales affected till the date of the’ death of the partner from the beginning of the year. The assumption in this method is that the net profit margin for current year will be same as the previous year. The share of the deceased partner profit will be calculated as follows

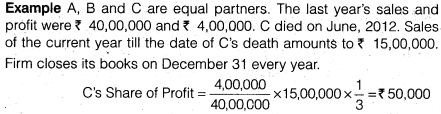

Example A, B and C are equal partners. The last year’s sales and profit were ? 40,00,000 and ? 4,00,000. C died on June, 2012. Sales of the current year till the date of C’s death amounts to ? 15,00,000. Firm closes its books on December 31 every year.

Last Updated on: December 05, 2025

-answer.png)