Chapter 5 Dissolution of Partnership Firm Questions and Answers: NCERT Solutions for Class 12 Accountancy (Partnership Accounts)

Class 12 Accountancy chapter 5 - Dissolution of Partnership Firm - Questions and Answers of NCERT Book Solutions.

Question 1. Dissolution of a partnership is different from dissolution of a firm.

Answer.True

In dissolution of partnership, business continues whereas in dissolution of firm, the business is closed.

Question 2. A partnership is dissolved when there is a death of a partner.

Answer True

As a new partnership deed is to be made

Question 3. A firm is dissolved when all partners give consent to it.

Answer True

As all partners agree to it.

Question 4: A firm is compulsorily dissolved when a partner decide to retire.

Answer False

The remaining partners may continue the business hence, it not necessary to dissolve the firm

Question 5. Dissolution of a firm necessarily involves dissolution of partnership..

Answer True

When firm does not exist then partners have no business to do.

Question 6. A firm is compulsorily dissolved when all partners or when all except one partner become involvent.

Answer True

As the partner becomes incompetent to sign the contract.

Question 7. Court can order a firm to be dissolved when a partner becomes insane.

Answer True

The court can order for dissolution when any partner files a suit for it.

Question 8. Dissolution of partnership can not take place without intervention of the court.

Answer False

Partnership can be dissolved with the consent of the partners also

SHORT ANSWER TYPE QUESTIONS

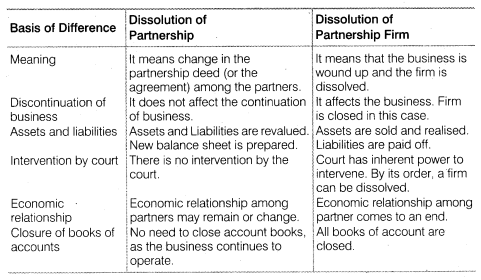

Question 1. State the difference between dissolution of Partnership and Dissolution of Partnership firm.

Answer The difference between the Dissolution’ of Partnership and Dissolution of Partnership Firm is as follows.

Question 2. State the accounting treatment for

(i) Unrecorded assets (ii) Unrecorded liabilities.

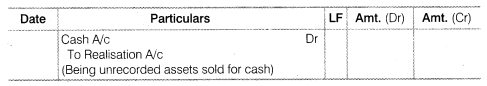

Answer.(i) Accounting Treatment for Unrecorded Assets Unrecorded asset is an asset, which have not been shown in the books of account or which has been written off in the books of accounts, but the asset is still available in physical condition. Sometimes it is sold outside for cash and sometimes it is taken away by the partner. The accounting treatment for unrecorded asset will be there according to the situation.

(a) When the unrecorded asset is sold for cash the following Journal Entry will be there

(b) When the unrecorded asset is taken over by any partner the following Journal Entry will be there

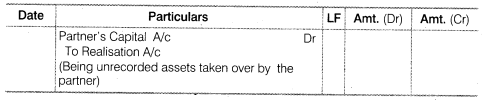

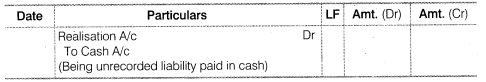

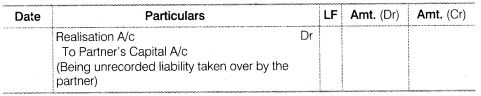

(ii) Accounting Treatment for Unrecorded Liabilities Unrecorded liabilities are those liabilities, which have not been shown in the books of account. But at the time of dissolution they are required to be paid off. The following Journal Entry will be there as per situation.

(a) When the unrecorded liability is paid off the following Journal Entry will be there

(b) When the unrecorded liability is taken over by a partner. The following Journal Entry will be there

Question 3. On dissolution, how will you deal with partner’s loan if it appears on the

(a) assets side of the balance sheet,

(b) liabilities side of balance sheet.

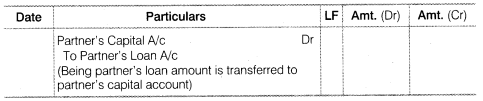

Answer (a) When loan amount is shown in the assets side of the balance sheet, it indicate that the loan has been granted by the firm to the partner. In that case, at the time of dissolution the amount of loan will be transferred to the concerned partner’s capital account. The following Journal Entry will be passed

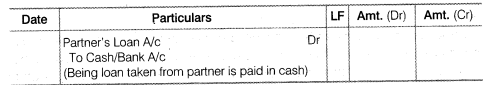

(b) When the amount of loan appears in the liabilities side of the balance sheet, it indicate that the respective partner or partners have given loan to the firm. In this case, partner’s loan will be paid off after paying all the external liabilities first. Here, it is worth mentioning that the partner’s loan will not be transferred to the realisation account, in fact, it will be paid in cash. The following accounting entry will be passed in this regard

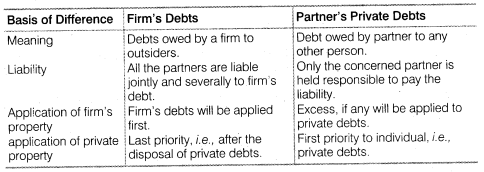

Question 4. Distinguish between Firm’s Debts and Partner’s Private Debts.

Answer The difference between Firm’s Debts and Partner’s Private Debts is as follows

Question 5. State the order of settlement of accounts on dissolution.

Answer In case of dissolution of a firm, the firm ceases to conduct business and has to settle its accounts. For this purpose, it

disposes off all its assets for satisfying all the claims against it. In this context, it should be noted that, subject to agreement among

the partners, the following rules as provided in Section 48 of the Partnership Act, 1932 shall apply. As per those rules, the following

order of settlement will be followed.

(i) Treatment of Losses

Note Losses, including deficiencies of capital, shall be paid

(a) First out of profits,

(b) Next out of capital of partners, and

(c) Lastly, if necessary, by the partners individually in their profits sharing ratio.

(ii) Application of Assets The assets of the firm, including any sum contributed by the partners to make up deficiencies of capital, shall

be applied in the following manner and order

(a) In paying the debts of the firm to the third parties;

(b) In paying each partner proportionately what is due to him/her from the firm for advances as distinguished from capital (i.e., partner’s loan);

(c) In paying to each partner proportionately what is due to him on account of capital; and

(d) The residue, if any, shall be divided among the partners in their profit sharing ratio.

Question 6. On what account Realisation Account differs from Revaluation Account?

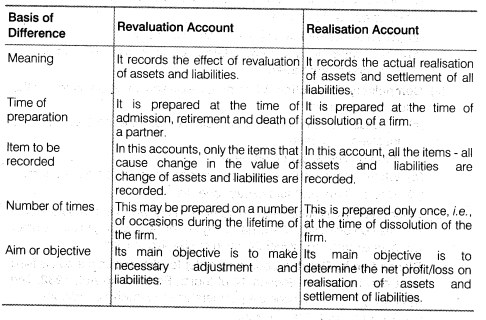

Answer There is the following difference between Realisation Account and Revaluation Account

LONG ANSWER TYPE QUESTIONS

Question 1. Explain the process of dissolution of partnership firm.

Answer Dissolution means breaking of relationship among the partners. As per Section 39 of the Indian Partnership Act 1932, the dissolution of firm implies that not only partnership is dissolved but the firm losses its existence, i.e., after dissolution the firm does not remain in business.

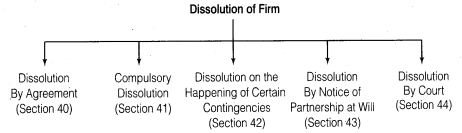

Dissolution of partnership firm implies discontinuation of the business of the partnership firm. Dissolution involves winding up of business, disposal of assets and paying off the liabilities and distribution of any surplus or borne of loss by the partners of the firm. As per the Partnership Act 1932, a partnership firm may be dissolved in the following manners.

(i) Dissolution by Agreement As a firm is formed with the consent of all partners with a mutual agreement. Dissolution can also be there with

the help of agreement. It happens in following two ways

A firm may be dissolved

(a) When all the partners agree to dissolve the firm.

(b) When there is any term related to dissolution of firm in the partnership agreement.

(ii) Compulsory Dissolution A firm may be dissolved compulsorily in the following condition

(a) In case, all the partners or all except one partner become insolvent or insane.

(b) If the business becomes illegal.

(c) Where all the partners except one decide to retire from the firm.

(d) Where all the partners except one die.

(iii) Dissolution by Notice When partnership is at will then the partnership firm may be dissolved, if any partner give notice in writing

to all the other partners expressing his/her intention to dissolve the firm.

(iv) Dissolution by Court A court may order for dissolution if a suit is filed by a partner, as per Section 44 of Indian Partnership Act,

1932. The court may order to dissolve a partnership in following conditions

(a) A partner becomes insane.

(b) A partner commits breach of agreement wilfully.

(c) When a partner’s conduct affects the business.

(d) When a partner transfers his interest to a third party.

(e) If business cannot be continued.

(f) If a partner becomes incapable of doing business.

(g) If court thinks dissolution to be just and equitable on any ground.

Besides these, above mentioned circumstances, a partnership firm may be dissolved if the court at any stage finds dissolution of the firm

to be justified and inevitable.

Question 2. What is a Realisation Account?

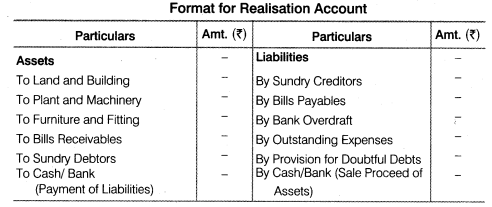

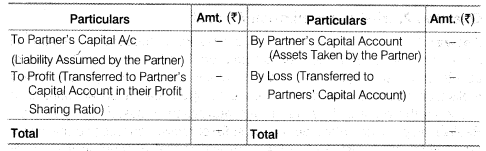

Answer On dissolution of a firm, all the books of account are closed, all assets are sold and all liabilities are paid off. In order to record the sale of assets and discharge of liabilities, a nominal account is opened named realisation account. The main purpose to open realisation account is to ascertain the profit or loss due to the realisation of assets and liabilities. Realisation profit (if credit side > debit side) or realisation loss (if debit side > credit side) are transferred to the partner’s capital account in their profit sharing ratio.Concisely, following are the important objectives of preparing realisation account

(i) To close all the books of account.

(ii) To record transactions relating to the sale of assets and discharge of liabilities.

(iii) To determine profit or loss due to the realisation of assets and liabilities.

Features of Realisation Account

(i) In realisation account, sale of assets is recorded at their realised value.

(ii) Payment to liabilities (creditors) is recorded at their settlement value.

(iii) After all the transactions have been recorded, there will be balance, which may be profit or loss.

(iv) Profit arises in two situations

(a) When assets are realised at more than their book value.

(b) When liabilities are settled at less than their book value.

(v) If the two conditions are vice versa, the net result will be loss.

(vi) The net profit or loss on realisation is to be transferred to the partner’s capital accounts in their profit sharing ratio.

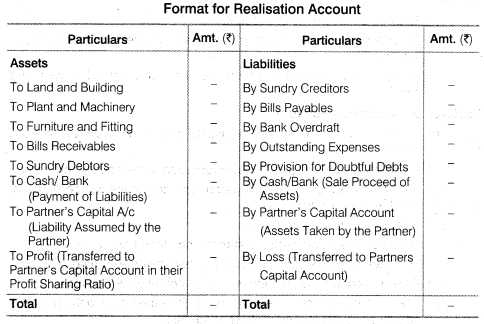

The format for realisation account is as follows

Question 3. Reproduce the format of Realisation Account.

Answer.

Question 4. How deficiency of creditors is paid off?

Answer When a firm gets into the situation of dissolution, first of all the amount received from the sale of firm’s assets are utilised to pay the creditors. After that, if the sale receipts of assets fall short, then partners’ private assets are used for settling the dues of the firm’s creditors. Even if some portion of the amount due to creditors is left unpaid, then there arises deficiency of

creditors. This deficiency is handled in the following two ways

(i) In first case, deficiency is transferred to the Deficiency Account.

(ii) In second case, the deficiency is transferred to the partner’s capital account.

In first case, a separate account is prepared for the firm’s creditors. Then in ‘ order to ascertain the firm’s cash balance accruing from the sale of the firm’s

assets and partners’ private assets, cash account is prepared. After ascertaining the cash availability with the firm, the creditors and the external liabilities are paid proportionately (partially). The remaining unpaid creditors or the deficiency is transferred to the Deficiency Account.

In the second case, the creditors are paid by the cash available with the firm

including the partners’ individual contribution. The deficiency or unpaid creditors amount .is transferred to the partner’s capital account. Thus, the deficiency of the creditors is borne by all the partners in their profit sharing ratio. If any partner becomes insolvent and is unable to bear the deficiency, then this will be regarded as a capital loss to the firm.

‘ If the partnership deed is silent, about such capital loss in the fact of insolvency of a partner, the deficiency on the insolvent partner’s capital ’ account must be borne by the other solvent partners, in proportion to their capital. In that case, we should apply Garner vs Murray decision in solving problems in partnership.

Last Updated on: Feb 26, 2024