Chapter 2 – Issue and Redemption of Debentures Questions and Answers: NCERT Solutions for Class 12 Accountancy (Company Accounts and Analysis of Financial Statements)

Class 12 Accountancy chapter 2 - Issue and Redemption of Debentures - Questions and Answers of NCERT Book Solutions.

1. Amrit Company Limited purchased assets of the book value of Rs.2,20,000 fromanother company and agreed to make the payment of purchase consideration by issuing 2,000, 10% debentures of Rs.100 each at a premium of 10%. Record necessary journal entries.

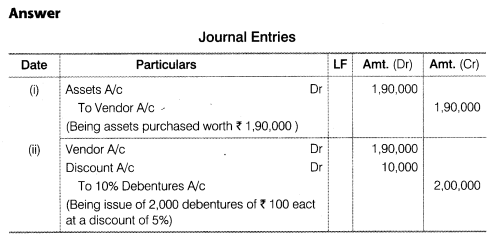

2. A company purchased assets of the value of Rs.1,90,000 from another company and agreed to make the payment of purchase consideration by issuing 2,000,10% debentures of Rs.100 each at a discount of 5%. Record necessary journal entries.

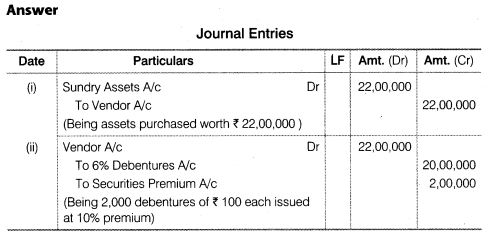

3. Rose Bond Limited purchased a business for Rs. 22,00,000. Purchase Price was paid by 6% debentures. Debentures of Rs. 20,00,000 were issued at a premium of 10% for the purpose. Record necessary journal entries.

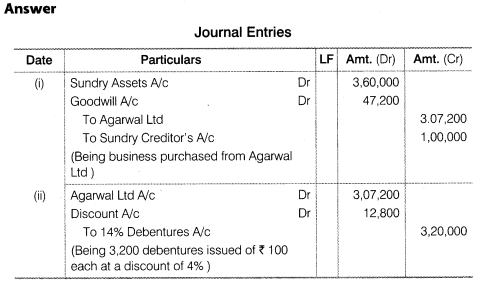

4. Nikhil and Ashwin Limited bought business of Agarwal Limited consisting sundry assts of Rs. 3,60,000, sundry creditors Rs. 1,00,000 for a consideration ofRs. 3,07,200. It issued 14% debentures of Rs. 100 each fully paid at a discount of 4% in satisfaction of purchase consideration. Record necessary journal entries.

Note If business is purchased and assets and liabilities are mentioned along with purchase price, pass a journal entry. To balance the entry use word ‘Goodwill’ if difference is on debit side and word ‘Reserves’ if difference is on credit side.

SHORT ANSWER TYPE QUESTIONS

Question 1. What is meant by a Debenture?

Answer Debenture The word ‘Debenture’ has been derived from a Latin word ‘debere’ which means to borrow.

Debenture is a written instrument acknowledging a debt under the common seal of the company. It contains a contract for repayment of principal after a specified period or at intervals or at the option of the company and for payment of interest at a fixed rate payable usually either half-yearly or yearly on fixed dates.

According, to Section 2(12) of The Companies Act, 1956 ‘Debenture’ includes Debenture Stock, Bonds and any other securities of a company whether constituting a charge on the assets of the company or not.

Question 2. What does a Bearer Debenture mean?

Answer Bearer debentures are the debentures which can be transferred by way of delivery and the company does not keep any record of the debenture holders. Interest on debentures is paid to a person who produces the interest coupon attached to such debentures.

Question 3. State the meaning of ‘Debentures issued as a Collateral Security’.

Answer Collateral security is given in addition to the primary security to the loan provider. In case when a company takes some loan it may issue debentures for additional security besides the primary security to that particular bank or financial institution.

Here it is to be remember that issue of debenture in ordinary course is different from issue of debenture as collateral security, in ordinary course debenture holders are entitled to get interest at an specified coupon rate where as in case of debenture issued as collateral security the holder of these debenture is not entitled to any such interest.

But in case of any default in payment of principle or interest of loan it may recover its amount from the issue of such debenture in the secondary market. Here it should be remembered that first of all the primary security will be sold after that debenture as collateral security will be used.

Question 4. What is meant by Issue of debentures for consideration other than Cash’?

Answer When a company purchase some assets it is supposed to pay the purchase consideration in cash but sometimes due to lack of sufficient fund, company may issue debenture for the payment of such purchase consideration. This is known as issue of debenture for consideration other than cash. The issue of debenture for consideration other than cash serves the purpose of both the vendor as well as of the purchaser (company). From the purchaser’s point of view, purchasing an asset against the issue of debentures requires no additional cost for raising loans or arranging funds immediately. On the other hand, the vendor gets interest on the amount of debentures received. In this case, payment is deferred by issue of debentures and interest is paid for time lag. Here it should be remembered that such debentures may be issued at par, premium or discount to the vendor.

Question 5. What is meant by ‘Issue of debentures at discount and redeemable at premium?

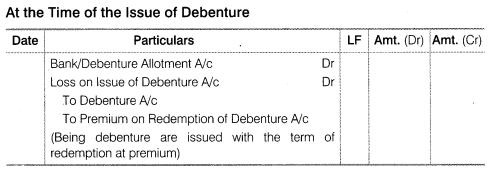

Answer As per the prevailing market circumstances sometimes company has to manage funds by issuing debenture below its par value and to attract the investor when these are redeemed at price higher than its par value, then it is termed as issue of debenture at discount and redeemable at premium.

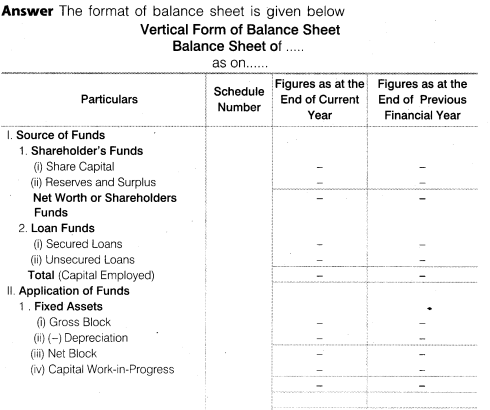

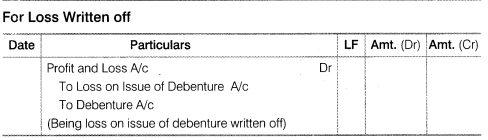

The difference between the issue price and the redemption price is treated as loss on issue of debenture and posted in assets side of the company as miscellaneous expenditure. To have a better understanding about the issue we may take an example as follows

Example: A 10% debenture of ? 100 each is issued at 5% discount and is redeemed at 5% premium. The following Journal Entry will be passed for that

Question 6 What is ‘Capital Reserve’?

Answer Capital Reserve is a reserve that is created out of capital profits. Capital profits are those profits arising out of those activity which are not part of the business operations e.g., premium on issue of share and debentures, profits of sale of fixed asset, profit on redemption on debenture and profit on reissue of forfeited share and so on.

A capital reserve can be utilised for meeting the future capital losses. Here it is to be remembered that capital reserve cannot be used for distributing dividend to the share holders but bonus shares can be issued out of the capital reserve.

Question 7 What is meant by a ‘Irredeemable Debenture?

Answer Irredeemable Debentures are those debentures which may not be redeemed during the life of a Company. They can only be paid off in the event of winding up of the Company. The holder of such debenture will enjoy interest on these debentures throughout the life of the company. Now-a-days no company issue irredeemable debentures.

Question 8. What is a ‘Convertible Debenture?

Answer Convertible Debentures are those debentures which are convertible in equity shares after some specified time generally mentioned at the time of issue of such debentures. These convertible debentures are divided into two categories

(i) Partly Convertible Debenture: In this type of debenture only a part of such debenture is convertible in equity shares which is mentioned at the time of issue.

(ii) Fully Convertible Debenture :These are fully convertible into equity shares. It means in case of fully convertible debenture the whole amount of such debenture, is convertible in equity share after the period mentioned in the prospectus.

Question 9. What is meant by ‘Mortgaged Debentures?

Answer Debentures which are secured against asset/s of a company known as Mortgaged Debenture. Mortgage Debentures are of two types first fixed charge mortgage debenture and second floating charge mortgage debentures.

When debentures are secured against a particular asset, then they are called fixed charge whereas, if the debentures are secured against all the assets of a company, then it is called floating charge. Mortgage debentures can only be sold by the holder when company fails to pay its loan or interest there on.

Question 10. What is discount on issue of debentures?

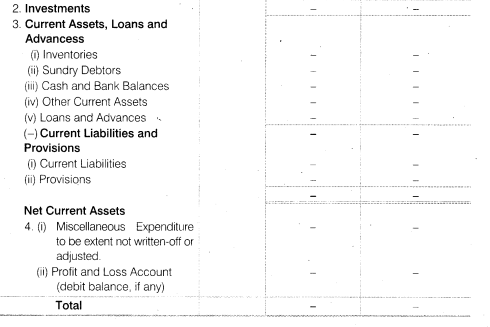

Answer Debenture is said to have been issued at discount where an applicant is required to pay a total sum less than the face value of the debenture. The excess of the face value over the issue price is regarded as the discount. When debentures are issued at a discount, cash account is debited with net sum received, the discount on debentures account is debited with the amount of discount allowed and the debentures account is credited with the full nominal value of the debentures. Here it is worth mentioning that there is no legal restriction on the companies for issuing debentures at discount. Maximum limit for discount on debentures is also not prescribed by the Companies Act. However, this Act requires that the amount of discount must be shown on the assets side of the Balance Sheet till written off under the head “Miscellaneous Expenditure.”

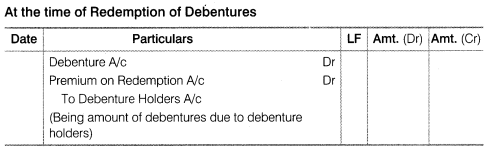

Question 11. What is meant by ‘Premium on Redemption of Debentures’?

Answer When the debentures are redeemed at a price more than its face value or the par value, then it is said that the debentures are redeemed at premium. The difference between the redeemed price and the par value is regarded as a capital loss and this loss is written off till the redemption of the debentures.

The Premium on Redemption of Debenture is shown on the Liabilities side of the Balance Sheet under the head of “Current Liabilities and Provisions” debentures are redeemed. –

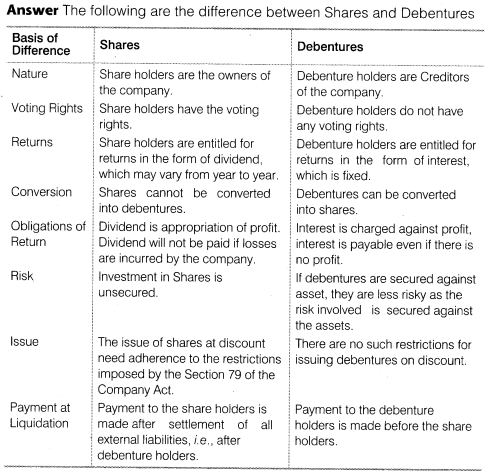

Question 12. How debentures are different from shares? Give two points.

Answer Nature: A share is a part of the capital of the company and a debenture is a part of loan of the company.

Dividend or Interest :Dividend on shares is paid only when there are profits in

the company on the other hand debenture interest has to be paid, it the company does not have profit or even suffer a loss.

Ownership Equity share holders are the owners of the company on the other hand debenture holders are the creditors of the company.

Question 13. Name the head under which ‘Discount on Issue of Debentures’ appears in the Balance Sheet of a company.

Answer As we know that Discount on Issue of debentures is a capital loss and it will be written off out of the profit of coming years, Therefore, it is shown on the Assets side of the Balance Sheet under the heading of “Miscellaneous Expenditures” until it is written off.

Question 14. What is meant by redemption of debentures ?

Answer The term redemption implies the discharge of an obligation arising out of the contractual obligations created through the debenture Trust Deed. In other words, discharge of the liability on account of debentures is called redemption of debenture.

The redemption of debentures is made by the company in accordance with the terms and conditions of issue. Debentures may be redeemable at par, premium or discount, but in present scenario redemption of debentures at par and at premium is most popular. The redemption can be done out of profits or from the fresh issue of debentures or shares.

Redemption of debentures may be done by the following methods

- By paying after stipulated period

- By annual drawing

- By conversion into shares or new debentures

- By purchasing own debentures in the open market

- At the option of the company

Question 15. Can the company purchase its own debentures?

Answer Yes, a company, if authorised by its Articles of Association, can purchase its own debentures in the open market. The main purposes of such purchase may be as follows

- A company may purchase its own debenture for immediate cancellation for reducing the debenture liability especially in case when the interest rate on its debenture is higher than the market rate of interest.

- A company may also purchase its own debentures with the motive of investment and sell them at higher price in future and thereby earn profit.

Question 16. What is meant by redemption of debentures by conversion?

Answer Debentures are usually redeemed in cash but sometimes privilege is given to the debenture holders to exchange their debentures either for shares or for new debentures of the company. The redemption of debentures by means of shares or new debentures is known as redemption by conversion and the debentures which carry such a right is called convertible debentures.

Question 17. How would you deal with ‘Premium on Redemption of Debentures?

Answer When the debentures are redeemed at a price more than its face value or the par value, then it is said that the debentures are redeemed at premium. The difference between the redeemed price and the par value is regarded as a capital loss and this loss is written off till the redemption of the debentures.

The Premium on Redemption of Debenture is shown on the Liabilities side of the Balance Sheet under the head of Current Liabilities and Provisions until debentures are redeemed.

Accounting Treatment for Premium on Redemption on Debentures

Question 18. What is meant by ‘Redemption out of Capital’?

Answer: When debentures are redeemed out of current resources, the working capital of the company are reduced to that extent, and therefore, it is called redemption out of capital.

In other words when debentures are redeemed out of capital and no profits are utilised for redemption, then such redemption is termed as redemption out of capital.

A company cannot redeem its debentures purely out of capital. At least 50% of debentures issued must be redeemed out of profits by creating a ‘Debenture Redemption Reserve’ and the balance of debentures issued may be redeemed out of profits or out of capital.

According to the Companies Act, 1956 when debentures are to be redeemed an adequate amount of profits is required to be transferred to ‘Debenture Redemption Reserve’ every year before the redemption begins. It is to be noted that the Companies Act, 1956 does not spell out at to what is the adequate amount.

For this one can refer to SEBI Guidelines which stipulates that an amount equal to 50% of the issue of the debentures should be transferred to ‘Debenture Redemption Reserve’ before the redemption begins.

There are exceptions in the following cases

- Infrastructure companies (i.e., those companies that are engaged in the business of developing, maintaining and operating infrastructure facilities)

- A company that issues debentures with a maturity up to 18 months.

- In case of Convertible debentures and convertible portion of partly convertible debentures

Question 19. What is meant by redemption of debentures by ‘Purchase in the Open Market?

Answer: A company, if authorised by its Articles of Association, can redeem its own debentures by purchasing them in the open market. This is advantageous for several reasons

- It would be saving the amount of interest on debentures purchased and cancelled.

- Sometimes the own debentures are being sold at a discount. It would enable the company to save money equai to the amount of discount i.e., profit on redemption of debentures.

- Debentures so purchased may be kept alive as investment. In need of fund, they can again be sold off in the market.

Objectives There may be the following objectives foP purchasing own debentures in the open market

(i) For immediate cancellation of debentures.

(ii) For investment in the own debentures.

Objectives There may be the following objectives foP purchasing own debentures in the open market

Question 20. Under which head is the ‘Debenture Redemption Reserve’ shown in the Balance Sheet.

Answer The Debenture Redemption Reserve is shown on the Liabilities side of the Balance Sheet under the head Reserve and Surplus.

LONG ANSWER TYPE QUESTIONS

Question 1. What is meant by a debenture? Explain the different types of debentures?

Answer Debenture: The word ‘Debenture’ has been derived from a Latin w’ord ‘Debere’ which means to borrow. Debenture is a written instrument acknowledging a debt under the common seal of the company. It contains a contract for repayment of principal after a specified period or at intervals or at the option of the company and for payment of interest at a fixed rate payable usually either half-yearly or yearly on fixed dates.

According, to Section 2(12) of The Companies Act, 1956 ‘Debenture’ includes Debenture Stock, Bonds and any other securities of a company whether constituting a charge on the assets of the company or not. There are various types of Debentures.

- From Security Point of View :From security point of view debentures can be classified into two broad categories naked or simple debentures and Mortgaged debentures.

(a) Naked or Simple Debentures :Naked or Simple Debentures are those debentures which do not carry any security in respect of repayment of interest or the principal. The general solvency of the company is the only security for the holders of simple debentures.

(b) Mortgaged Debentures: Mortgaged Debentures are the debentures which are secured by a charge on the asset or properties of the company. The debenture holders have the right to recover their principal amount as well as unpaid interest out of the assets mortgaged by the company.

In case of mortgage debentures, a company may prefer to appoint trustees who will hold the property given by way of security in trust for the benefits of debentures holders.

- From Permanence Point of View the debentures may be Redeemable or Irredeemable debentures.

(a) Redeemable Debentures Redeemable debentures provide for the payment of principal amount on the expiry of certain period. Redeemable debentures can be reissued even after they have been redeemed until they have been cancelled.

(b) Irredeemable Debentures Irredeemable Debentures are retained as a part of the permanent capital structure during the life time of the company. Such debt becomes due for payment only when the company goes into liquidation or when the payment of interest is not made regularly.

The company has the option of cancelling its liability to the debenture holders at any time by giving due notice to them.

- From Priority Point of View :From this point of view the debentures may be First and Second debentures.

(a) First Debentures :First Debentures are those debentures which are paid first before any payment is made to another type of debentures.

(b) Second Debentures: Second Debentures are those debentures which are paid after making the payment of first debentures.

- From Recording Point of View :From recording point of view debentures can be classified into two categories bearer and registered debentures.

(a) Bearer Debentures :Bearer Debentures are transferable per bearer without endorsement and they are just like bearer cheques or government currency notes. They are treated as negotiable instrument and transferable by mere delivery. It is not necessary that transfer of such debentures should be registered with the company. The interest is paid to the holder irrespective of identity.

(b) Registered Debentures: Registered debentures are made out in the name of a particular person who is registered by the company as a holder and are transferable in the same way as shares.

The payment of interest and repayment of capital is made to those whose name are registered with the company and duly entered in the register of debenture holders.

- From Conversion Point of View: From conversion point of view debentures may be convertible or non-convertible.

(a) Convertible Debentures :Convertible debenture holders are given an option to convert them into equity or preference shares at a stated rate of exchange after a certain period. Convertible debentures are very popular these days with the companies as it provides them a major source of permanent working capital. It also provides safety, liquidity, capital appreciation and assured return to the investors.

(b) Non-Convertible Debentures: Non-convertible debentures are not convertible into equity or preference shares afterwards.

In case of mortgage debentures, a company may prefer to appoint trustees who will hold the property given by way of security in trust for the benefits of debentures holders.

Question 2. Distinguish between a debenture and a share. Why debenture is known as loan capital? Explain.

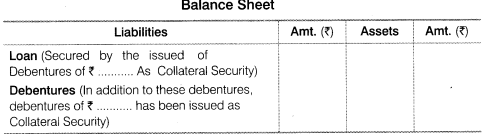

Question 3. Describe the meaning of ‘Debenture Issued as Collateral Securities’. What accounting treatment is given to the issue of debentures in the books of accounts?

Answer When a company takes a loan, it has to give some security, it may do so by giving debentures to the party from whom loan is takes. If on the due date principal is paid back by the Company and interest is also paid, the loan-giver will return the debentures to the Company and then they will be cancelled by the Company,

If the Company makes a default, the bank may either keep the debenture and become debenture-holder or sell them and realise money. This type of issue by the Company is called Issue of Debenture as Collateral Security.

When debentures are issued by the company, they are not really alive and no accounting entry is made in the books of the Company for it. Only a note is given in the balance sheet for it as under

If an accounting record for these debentures is to be made Debentures Suspense A/c is debited and deoentures A/c credited, debentures are shown in the liability side and balance of debentures Suspense A/c is shown in the assets side of the Balance Sheet. When debt is paid off by the Company, Debentures A/c is debited and Debentures Suspense A/c is credited.

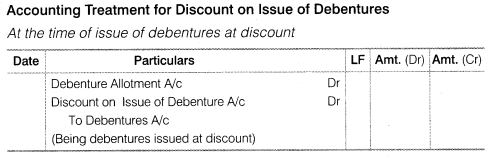

Question 4. How is ‘Discount on Issue of Debentures’ treated in the books of accounts? How will you deal with the ‘Discount on issue of debentures’ when the debentures are to be redeemed in instalments?

Answer When the debentures are issued at a price below its par value or face value, then it is said that the debentures are issued at discount. The difference between the issue price and the face value of the debenture is regarded as a capital loss. This loss is written off every year till the debentures are redeemed.

The loss on the issue of debenture is shown on the Assets side of the Balance Sheet under the heading of Miscellaneous Expenditures.

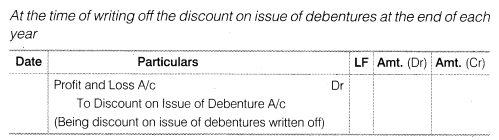

Accounting Treatment for Discount on Issue of Debentures:

At the time of issue of debentures at discount

At the time of writing off the discount on issue of debentures at the end of each year

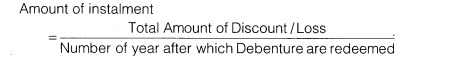

(i) Fixed Instalment Method/Equal Instalment Method : This method is used when debentures are redeemable in lump sum after a specified period of time. In this case an equal amount of discount (loss) is written off in equal instalments over the life of the debenture. The formula for calculating amount of discount written off every year is given below

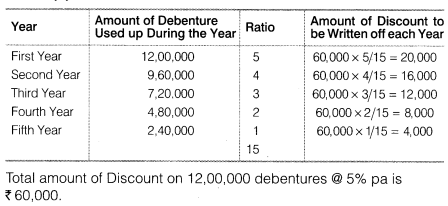

(ii) Fluctuating Instalment Method/Variable Instalment Method/ Proportion Method: When debentures are repaid by annuaLdrawings or in instalments, the discount should be written-off in the ratio of

debentures outstanding as at the end of each accounting year. The amount of discount, under this method, goes on reducing every year and so this method may also be known as Reducing Instalment Method. –

e.g., if a company has issued 10% debentures of Rs. 12,00,000 at 5% discount redeemable annually by Rs. 2,40,000 each year. The total amount of discount on Rs.12,00,000 debentures @ 5% is Rs. 60,000, i.e., (12,00,000 x 5/100 =Rs. 60,000). The amount of discount to be written off every year is calculated as

Hence, the amount of the total discount of’ 60,000 will be written off in the ratio of ,5 : 4 : 3 : 2 :1 i.e.,’ 20,000,’ 16,000,’ 12,000,’ 8,000 and 4,000 respectively.

Question 5. Explain the different terms for the issue of debentures with reference to their redemption.

Answer Debentures can be issued at par, at premium and at discount in the same way they can be redeem at par and at premium. Debentures can never be redeemed at discount. The following are the six situation under which debentures can be issued to their redemption.

(i) Issue at Par and Redeemable at Par: When the debentures are issued and are redeemed at their face value, then the following Journal entry is passed.

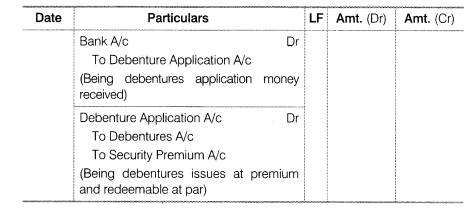

(ii) Issue at Premium and Redeemable at Par When the debentures are issued at premium and redeemable at par, then the following Journal entry is passed. As premium is a gain for a company so it is credited in the Journal entry.

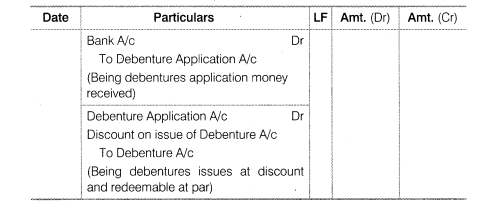

(iv)Issue at Discount and Redeemable at Par When the debentures are issued at discount and redeemable at par, then the following Journal entry is passed. As discount is a loss for a company so it is debited in the Journal entry.

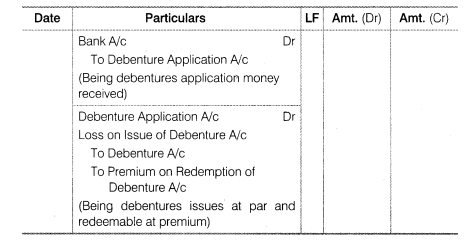

(v) Issue at Premium and Redeemable at Premium When debentures are issued at par and redeemable at premium, then the following Journal entry is passed. In such case, the company did not suffer any loss at the time of issue but there will be loss at the time of redemption.

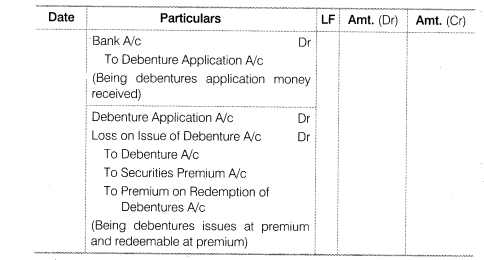

(vi) Issue at Discount and Redemption at Premium When the debentures are issued at discount and redeemable at premium, then the following Journal entry is passed.

Question 6. Differentiate between redemption of debentures out of capital and out of profits.

Answer Debentures can be redeemed out of capital and out of profits. The following are the difference between these two methods.

Redemption of Debentures Out of Capital: This is the situation where debentures are redeemed out of capital and no profits are utilised for redemption of the debentures, such redemption is termed as redemption out of capital. In this situation, no profits are required to be transferred to the Debenture Redemption Reserve (DRR).

Here it is to be remembered that no company can redeem its debenture purely out of capital because as per the guideline laid down by Securities and Exchange Board of India (SEBI) and the Section 117C of Company Act of 1956, before starting any redemption process a company is required to create a DRR equal to 50% of the debentures issued).

create a DRR equal to 50% of the debentures issued).

Therefore, it is not possible to redeem debentures purely out of capital, as it reduces the value of assets. There are exceptions in the following case

- Infrastructure companies (i.e., those companies that are engaged in the business of developing, maintaining and operating infrastructure facilities)

- A Company that issues debentures with a maturity up to 18 months.

- In case of convertible debentures and convertible portion of partly convertible debentures.

Redemption of Debenture Out of Profits:When debentures are redeemed out of profit then no capital is utilised for redemption. Before redeeming the debentures profits are transferred to DRR from Profit and Loss Appropriation Account. The creation of DRR is mandatory as per the guidelines laid down by Securities and Exchange Board of India (SEBI).

SEBI mandates transferring amount equal to 50% of debentures issued to DRR before redeeming debentures. As transfer of amount (profits) to the DRR from Profit and Loss Appropriation Account reduces the amount of profit available for distribution of dividend, so this redemption process is known as redemption out of profit.

DRR is shown under the head of Reserves and Surpluses on the Liabilities side of the Balance Sheet. DRR account is closed by transferring it to General Reserve only when all the debentures are redeemed.

Question 7. Explain the guidelines of SEBI for creating Debenture Redemption Reserve.

Answer Securities and Exchange Board of India (SEBI) have provided some guidelines for redemption of debentures. The focal points of these guidelines are *

- Every company shall create Debenture Redemption Reserve in case of issue of debenture redeemable after a period of more than 18 months from the date of issue.

The creation of Debenture Redemption Reserve is obligatory only for non-convertible debentures and non-convertible portion of partly convertible debentures.

A company shall create Debenture Redemption Reserve equivalent to at least 50% of the amount of debenture issue before starting the redemption of debenture.

Withdrawal from Debenture Redemption Reserve is permissible only after 10% of the debenture liability has already been reduced by the company.

SEBI guidelines would not apply under the following situations:

(i) Infrastructure company (a company wholly engaged in the business of developing, maintaining and operating infrastructure facilities), and

(ii) A company issuing debentures with a maturity period of not more than 18 months.

Question 8. Describe the steps for creating Sinking Fund for redemption of debentures.

Answer The steps involved in creation of Sinking Fund on redemption of Debenture are

- Calculate the amount of profit to be set-aside annually with the help of sinking fund table.

- Set aside the amount of profit at the end of each year and credit to Debenture Redemption Fund (DRF) Account.

- Purchase the investments of the equivalent amount at the end of first year and debit Debenture Redemption Fund Investment (DRFI) Account.

- Receive interest on investment at the end of each subsequent year.

- Purchase the investments equivalent to the fixed amount of profit set aside and the interest earned every year except last year (year of redemption).

- Receive interest on investment for the last year.

- Set aside the fixed amount of profit for the last year.

- Encash the investments at the end of the year of redemption.

- Transfer the profit/loss on sale of investments reflected in the balance of Debenture Redemption Fund Investment Account to Debenture Redemption Fund Account.

- Make payment to debenture holders.

- Transfer Debenture Redemption Fund A/c balance to General Reserve.

Question 9. Can a company purchase its own debentures in the open market? Explain.

Answer Yes, a company, if authorised by its Articles of Association, can purchase its own debentures in the open market. The main purposes of such purchase may be as follows

(i) A company may purchase its own debenture for immediate cancellation for reducing the debenture liability especially in case when the interest rate on its debenture is higher than the market rate of interest.

(ii) A company may also purchase its own debentures with the motive of investment and sell them at higher price in future and thereby earn profit.

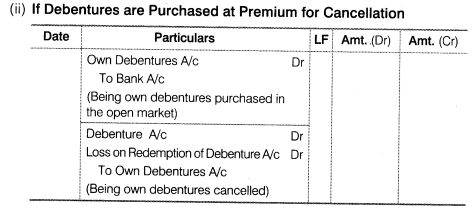

When a company purchase its own debenture,in the open market it can happen in either of the two ways first debentures may be purchased at premium for cancellation and debenture may be purchase at discount for cancellation. The following will be the accounting treatment in both situation.

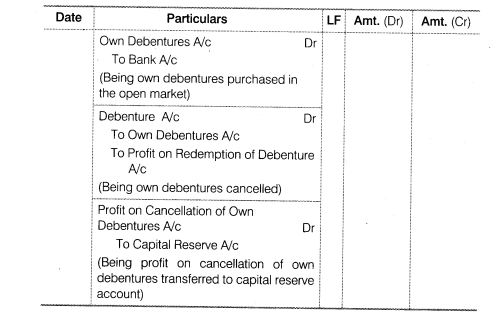

(i) If Debentures are Purchased at Discount for Cancellation :When the company purchase its own debentures at discount for cancellation, then the following Journal entries are recorded.

Question 10. What is meant by conversion of debentures? Describe the method of such a conversion.

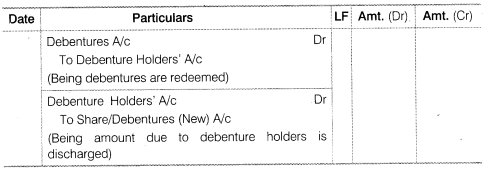

Answer The debentures can also be redeemed by converting them into shares or new debentures. If debenture holders find that the offer is beneficial to them they may convert his/her debentures into shares or new debentures after the expiry of a specified period of time, then this whole process is known as redemption of debentures by conversion.

It is worth mentioning here that in such a case no Debenture Redemption Reserve is required because no funds are required for redemption.

If a debenture holder exercises the conversion option, then the issue price of shares must be equal to or less than the amount .actually received from debentures. The accounting treatment in that case will be as follows:

Last Updated on: Feb 26, 2024