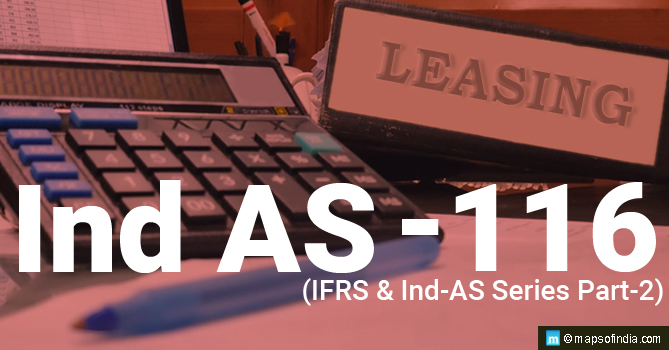

Ministry of Corporate Affairs (MCA) has recently notified Ind AS 116, the new leases accounting standard on 30th March 2019 with the effective date of its application from 1st April 2019 implying from this fiscal year, it shall be mandatory for all companies to follow the Ind AS -116 which replaces the current guidance in Ind AS-17, ‘Leases’.

Major Points:

1. Ind AS 116 has defined a lease as a contract, or part of a contract, that conveys the “Right to Use” an asset (the underlying asset) for a period of time in exchange for consideration.

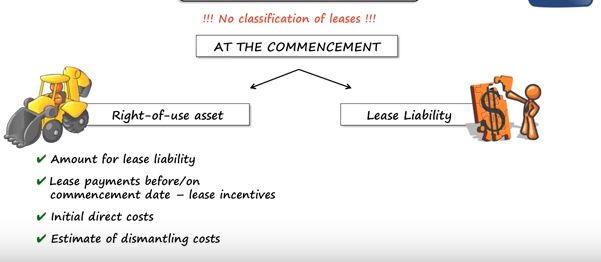

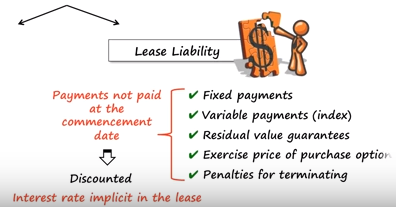

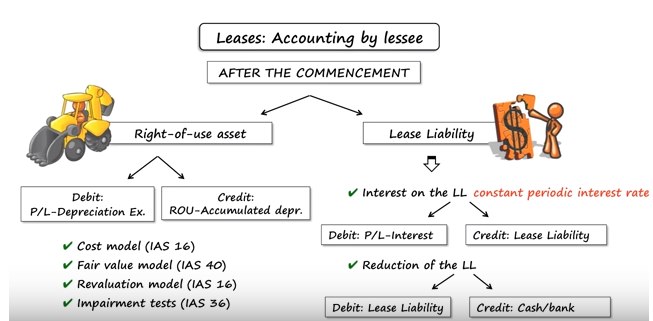

2. Under Ind AS 116, the lessees (users or tenants) must recognize a lease liability (amount payable) reflecting future lease payments and a ‘Right-of-use asset’ (Being Intangible assets- capitalize the Intangible) for almost all lease contracts.

3. This is a significant change as compared to earlier Ind AS 17, under which lessees were required to make a distinction between a finance lease (on balance sheet- assets) and an operating lease (off balance sheet- expense only as rentals paid).

4. Ind AS 116 also gives lessees optional exemptions for certain short-term leases (1 year or less) and leases of low-value assets (small photocopiers or small value items).

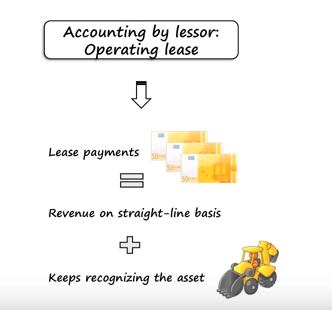

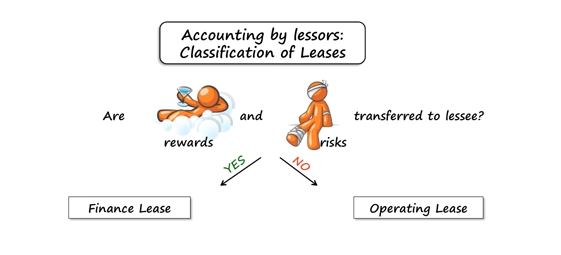

The accounting by lessors will not significantly change though. Like earlier under Ind AS 17, the lessor will continue to classify leases as either finance or operating, depending on whether substantially all of the risks and rewards incidental to ownership of the underlying asset have been transferred. This process will be now similar to the new standard also.

Ind AS 116 adds significant new, enhanced disclosure requirements for both lessors and lessees.

1. On transition, lessees have a choice between

a) full retrospective application or

b) a simplified approach that includes certain reliefs and does not require a restatement of comparatives.

In addition, as a practical expedient entities are not required to reassess whether a contract is, or contains, a lease at the date of initial application (that is, such contracts are ‘grandfathered’).

2. Certain exemptions (not to apply this lease new accounting):

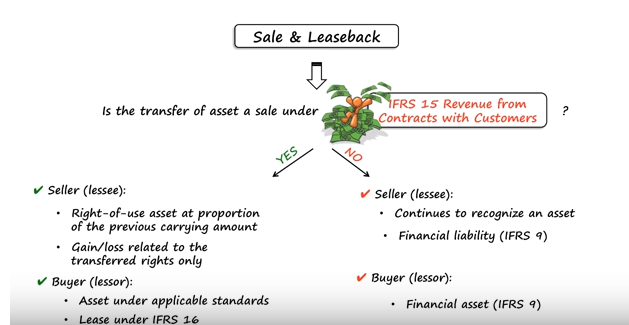

a. Less than 1 year

b. If the assets are small in values (computers etc)

3. No classification of leases (into operating or finance lease) by the Lessee. To capitalize both

4. At the inception of lease , he will create a Lease Asset and also a Liability corresponding to that.

5. The Lease Liability must also include the following:

6. The accounting on both sides must take care of the following:

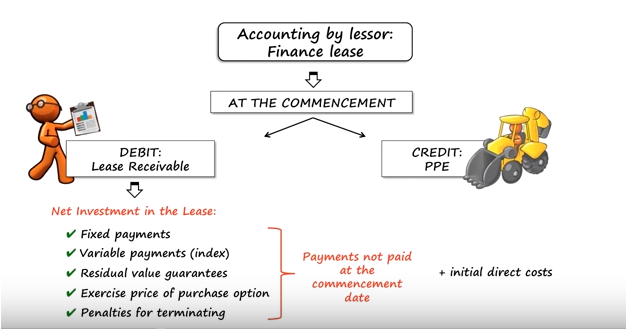

7. For the Lessors, nothing much changes from the previous standard. It means, you must classify the lease first and based on the classification, the accounting will happen. Operating, you will take into Income and finance lease, Lease Receivable and then reduce by the amount recd.

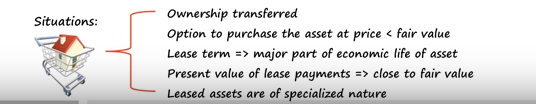

8. At the inception of lease , we must answer this question (same as earlier standard )

9. Nature wise, if any condition is fulfilled, it shall be a Finance lease otherwise a operating lease only This must be done at the inception of lease only.

10. For Lessor, the accounting shall remain the same only like earlier. For the sake of completion, let me complete this by mention of how it is done.

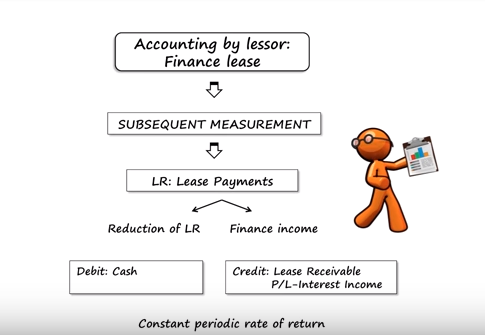

11. For subsequent measurements /payments,

12. For Operating Leases, the Lessor will depreciate the asset also

13. Just in case, there is a sale and lease back transaction, then following shall be done.

Note – IFRS 16 is Ind AS-116 and IFRS-9 is Ind AS 109.

Let’s take an example of a Lease assets:

1. Say Lease expense is 25,000 per month or 3lacs a year

2. Lease is of 3 years

3. Let’s make a table of Discounting and amortization. For discounting, rate are G-Sec rate (10 years Govt sec rate in India) Here it is taken at 6.7%

Using the above data, following table is created:

| G Sec Rate | 0.937207123 | 0.878357191 | 0.823202616 | |||

| FY | FY | FY | ||||

| Rentals | 3 years agreement | 2019-20 | 2020-21 | 2021-22 | Total | |

| 25:00.00 | 12 | 12 | 12 | 36 | ||

| Full Value | 300000 | 300000 | 300000 | 900000 | ||

| Fair Value | 281162 | 263507 | 246961 | 791630 | ||

| Year | Opening Lease Asset (A) | Lease Payment | Fair value calculation (B=A*6.7%) | Decrease in Lease Liability | Closing Lease Liablity | |

| 2019-20 | 791630 | 300000 | 53039 | 246961 | 544669 | |

| 2020-21 | 544669 | 300000 | 36493 | 263507 | 281162 | |

| 2021-22 | 281162 | 300000 | 18838 | 281162 | -1 | |

| Total | 900000 | 108370 | ||||

| Year | Ind AS-116 | Difference (Impact of equity) E=D-A | ||||

| Lease Expense (A) | Fair value impact (B) | Amortization (C ) | Total (D=B+C) | |||

| 2019-20 | 300000 | 53039 | 263877 | 316916 | 16916 | |

| 2020-21 | 300000 | 36493 | 263877 | 300370 | 370 | |

| 2021-22 | 300000 | 18838 | 263877 | 282715 | -17285 | |

| Total | 900000 | 108370 | 791630 | 900000 | 0 |

4. Accounting entries are as under:

| Accounting Entries: | |||||

| 2019 – Year 1 | Debit | Credit | |||

| Debit | Right to Use- Vehicle- Intangibles | 791630 | Asset creation entry | ||

| Debit | fair Valuation on Vehicles- Rights to Use | 108370 | |||

| Credit | Lease Liability to Landlord | 900000 | |||

| 900000 | 900000 | ||||

| 2019 | Debit | Credit | |||

| Debit | Amortization – RTU- Vehicles | 263877 | Amortization entry – year1 | ||

| Credit | Accumulated Amortization – RTU Vehicles | 263877 | B/s- Contra asset | ||

| 263877 | 263877 | ||||

| 2019 | Debit | Credit | |||

| Debit | Lease Liability to Landlord | 300000 | Payment entry- rent | ||

| Credit | bank | – | 300000 | B/s | |

| 300000 | 300000 | ||||

| 2019 | Debit | Credit | |||

| Debit | Amortization- fair value- Vehicles- RTU | 53039 | Fair value entry-year 1 | ||

| Credit | fair Valuation on Vehicles- Rights to Use | 53039 | b/s | ||

| 53039 | 53039 | ||||

| 2020- year 2 | Debit | Credit | |||

| Debit | Amortization – RTU- Vehicles | 263877 | Amortization entry | ||

| Credit | Accumulated Amortization – RTU Vehicles | – | 263877 | B/s- Contra asset | |

| 263877 | 263877 | ||||

| 2020 | Debit | Credit | |||

| Debit | Lease Liability to Landlord | 300000 | Liability entry | ||

| Credit | bank | 300000 | B/s | ||

| 300000 | 300000 | ||||

| 2020 | Debit | Credit | |||

| Debit | Amortization- fair value- Vehicles- RTU | 36493 | Fair value entry-year 2 | ||

| Credit | fair Valuation on Vehicles- Rights to Use | 36493 | b/s | ||

| 36493 | 36493 | ||||

| 2021- year 3 | Debit | Credit | |||

| Debit | Amortization – RTU- Vehicles | 263877 | Amortization entry | ||

| Credit | Accumulated Amortization – RTU Vehicles | 263877 | B/s- Contra asset | ||

| 263877 | 263877 | ||||

| 2021 | Debit | Credit | |||

| Debit | Lease Liability to Landlord | 300000 | Payment entry | ||

| Credit | bank | 300000 | B/s | ||

| 300000 | 300000 | ||||

| 2021 | Debit | Credit | |||

| Debit | Amortization- fair value- Vehicles- RTU | 18838 | Fair value entry-year 3 | ||

| Credit | fair Valuation on Vehicles- Rights to Use | 18838 | b/s | ||

| 18838 | 18838 | ||||

| 2020-21- year 3 end | Debit | Credit | |||

| Debit | Accumulated Amortization – RTU Vehicles | 791630 | Asset reversal entry –end period | ||

| Credit | Right to Use- Vehicle- Intangibles | 791630 | |||

| 791630 | 791630 |

In summary of entries:

A) We created an asset.

B) We amortized over the period the asset value.

C) Fair value impact also amortized over period.

D) At the end, assets life is over, and asset is also reversed.

Related Link:

IFRS and Ind AS – Practical Aspects In India- Series Part-1